Easily Make More Money With A Six-figure Business Exit Using QSBS

by Eric Lam - Published 1/10/2024

by Eric Lam - Published 1/10/2024

If you're a business owner or investor looking to maximize your returns and minimize your tax liabilities, the Qualified Small Business Stock (QSBS) could be a game-changer for you. In this comprehensive guide, we'll delve into the ins and outs of QSBS, exploring how it works, its requirements, benefits, risks, and how you can qualify and maximize its potential.

Whether you're considering an exit strategy, seeking tax exemptions on capital gains, or aiming for increased return on investment, understanding QSBS is essential. So, let's dive into the world of QSBS and explore how it could help you easily make more money with a six-figure business exit.

Key Takeaways:

- Maximize your tax savings by taking advantage of Qualified Small Business Stock (QSBS) tax exemptions on capital gains.

- Meet the requirements for QSBS eligibility, including owning stock in a qualified small business and holding onto it for the required period of time.

- Consult with a tax professional and plan your exit strategy to fully maximize the benefits of QSBS for your six-figure business exit.

What Is QSBS?

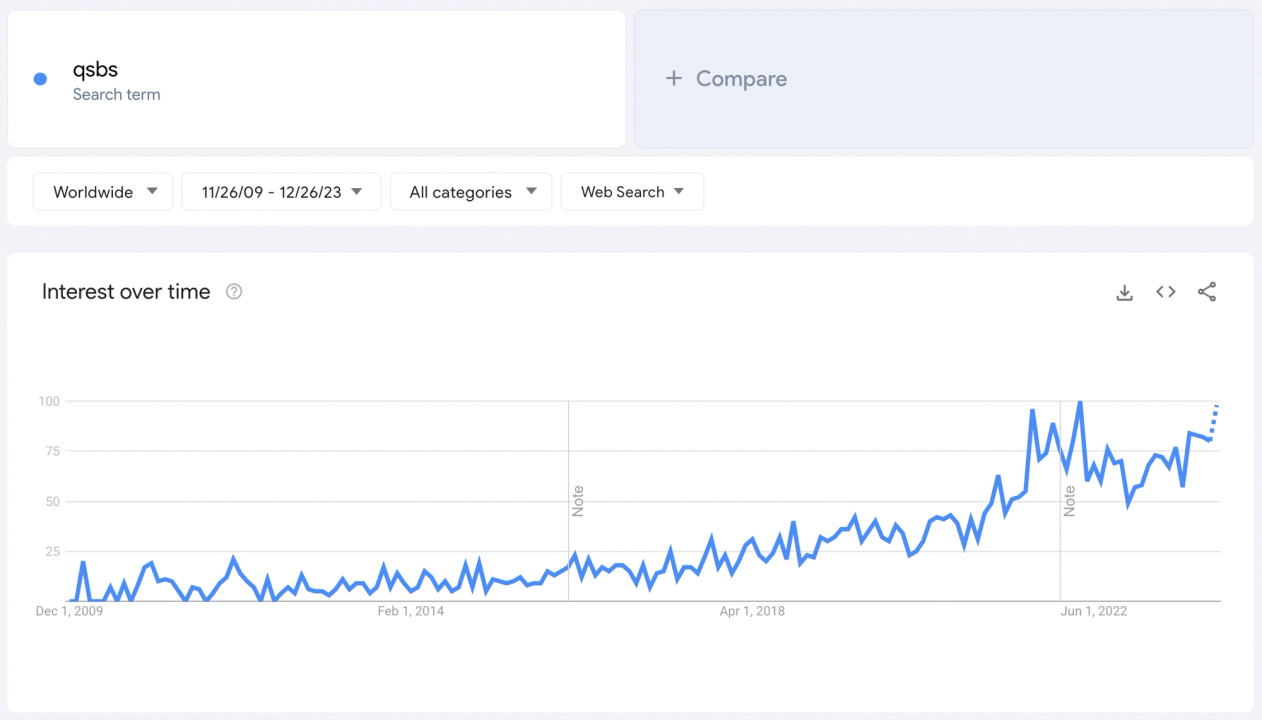

The concept of Qualified Small Business Stock (QSBS) has gained significant traction recently, particularly due to the economic fluctuations prompted by the pandemic.

QSBS, established under Section 1202 of the US Internal Revenue Code since 1996, offers substantial tax benefits to investors in small businesses.

Understanding QSBS

QSBS refers to stock in a small business that meets specific criteria set by the IRS. To qualify, the stock must be issued by a domestic C corporation with gross assets not exceeding $50 million at the time of issuance. The qualifications are extensive, here's some powerful tips for how to qualify. The corporation should be actively engaged in business; certain industries like finance and hospitality are excluded.

The primary advantage for investors is the potential for tax exemption on capital gains, it provides the ability to exclude up to 100% of gains from federal income taxes, subject to certain caps. This QSBS benefit is available if the stock is held for at least five years.

How Does QSBS Work?

QSBS operates by providing eligible small business shareholders with an exclusion of a portion or all of the capital gains realized from the sale of QSBS.

This tax incentive is designed to encourage investment in small businesses and startups, particularly in the technology sector, which often experience high growth potential and substantial capital gains. The gain exemption process involves meeting specific criteria, including a five-year holding period and satisfying the active business requirement. Shareholders who qualify for QSBS status can potentially enjoy significant tax savings, ultimately promoting entrepreneurship and innovation.

What Are The Requirements For QSBS?

To qualify for QSBS, certain criteria must be met by the small business and its shareholders as stipulated by federal regulations.

The small business must be a C corporation with gross assets not exceeding $50 million at the time of issuing the stock or the date of acquiring the stock. The business must have been in active operations and not primarily involved in certain professional services or other excluded industries.

As for the shareholders, they must have acquired the stock after September 27, 2010, and held it for at least five years to be eligible for the QSBS tax benefits. To benefit from the full exclusion of capital gains, the stock must have been acquired before January 1, 2015, and the business should have at least 80% of its assets and payroll within the United States.

Qualified Small Business

The designation of a qualified small business is determined based on specific eligibility criteria set forth by regulatory bodies such as the Small Business Administration and NerdWallet, Inc.

To be considered a qualified small business, companies must meet certain criteria related to their size, annual revenue, and industry classification. The Small Business Administration typically defines small businesses as those with fewer than 500 employees, while NerdWallet, Inc may use different parameters such as annual revenue or net worth.

Meeting these criteria can have significant implications for entrepreneurs, as it can allow access to various incentives and assistance programs designed to foster growth and sustainability. Qualifying as a small business may unlock potential tax benefits and investment opportunities, as governments and private entities often offer preferential treatment and funding support to these enterprises.

Stock Ownership Requirements

The stock ownership requirements for QSBS involve specific criteria related to the structure and ownership of shares, impacting aspects such as compensation, legal considerations, and potential returns for shareholders.

These requirements dictate that the shares must be acquired directly from the company, rather than through secondary market purchases. To qualify for the QSBS benefits, the shares must be held for a minimum of five years. The ownership and structure of shares within partnership arrangements need to adhere to these stringent requirements to qualify for the tax benefits associated with QSBS.

The implications for compensation arrangements resonate with the eligibility for QSBS. Any stock-based compensation should align with the regulations set forth to meet the QSBS criteria. This may significantly influence how partnership structures utilize equity-based incentives.

Legal frameworks surrounding Limited Liability Companies (LLCs) also come into play when discussing QSBS. Given that LLCs can be treated as partnerships for tax purposes, the ownership and share structure within LLCs must comply with QSBS requirements to avail of the associated tax benefits.

Holding Period Requirements

The holding period requirements for QSBS dictate the duration for which shareholders must retain their investment in a qualified small business, impacting considerations related to C corporations, the alternative minimum tax (AMT), and the guidance provided by tax advisers and college law programs.

These holding period requirements are a critical factor in determining the tax treatment of investments in QSBS. For C corporations, understanding the implications of holding periods is essential. The duration of the holding period can significantly impact the eligibility of stock for favorable capital gains tax treatment. The holding period requirements may also have implications for the alternative minimum tax (AMT), influencing the overall tax burden of shareholders.

Given the complexity surrounding these requirements, tax advisers play a crucial role in guiding shareholders through the various implications and strategies related to holding periods. Additionally, educational programs in law schools and other institutions are instrumental in shaping tax policies, including those related to QSBS and holding periods. By staying up-to-date with the latest developments and interpretations, tax advisers can provide invaluable assistance to shareholders seeking to navigate these intricate regulations.

What Are The Benefits Of QSBS?

The benefits of QSBS encompass substantial tax exemptions on capital gains, significantly impacting the income and tax liabilities of eligible shareholders and businesses.

These tax exemptions under the Qualified Small Business Stock (QSBS) provisions offer a major advantage for shareholders, as they can potentially exclude up to $10 million or 10 times their original investment, whichever is greater, from capital gains taxes. This allows individuals to retain a higher percentage of their investment proceeds, leading to increased personal income and wealth accumulation.

For businesses, QSBS status can enhance their market value by making them more attractive to potential investors and providing them with a viable incentive for raising capital. The long-term implication of QSBS extends beyond individual and corporate advantages to potentially influence overall tax revenues as well. By encouraging investment in small businesses and startups, the tax code supports innovation, job creation, and economic growth, contributing to the overall health of the economy.

Tax Exemption On Capital Gains

One of the primary benefits of QSBS is the exclusion of a significant portion or all of the capital gains from taxation, offering long-term potential returns and incentivizing investments in eligible small businesses.

Qualified Small Business Stock (QSBS) offers attractive tax exemptions, particularly in terms of capital gains.

For eligible investors, the potential to exclude a substantial portion or even all capital gains from taxation can have a profound impact on their effective tax rates and overall investment returns. This strategic tax advantage encourages individuals to allocate resources into small businesses, fostering economic growth and innovation.

The long-term benefits for investors are pronounced as they can potentially realize higher after-tax returns from their investments, thereby amplifying the overall financial rewards of backing qualifying small businesses.

Increased Return On Investment

QSBS offers the potential for increased returns on investment due to the tax advantages it provides, influencing ownership structures, compensation arrangements, and potential tax savings for investors and partners.

The Qualified Small Business Stock (QSBS) provides a significant tax incentive for investors and partners, as it allows eligible individuals to exclude a portion of the gains from the sale or exchange of QSBS from federal income tax. This tax treatment can enhance the after-tax returns on investments in qualifying small businesses. Consequently, QSBS can influence the ownership dynamics by attracting more investors seeking tax-efficient opportunities.

The potential tax savings from QSBS can have a cascading effect on the compensation structures within the business, enabling companies to offer competitive remuneration packages to key personnel.

Lower Tax Rate For Qualified Dividends

Another benefit of QSBS is the opportunity for lower tax rates on qualified dividends, presenting corporate tax incentives and potential returns for eligible shareholders based on gross assets and investment structures.

Given the lower tax rates on qualified dividends, shareholders of qualified small business stock can enjoy reduced tax liabilities on their dividend income, providing a favorable tax environment for investors. This tax advantage serves as an attractive feature for shareholders, contributing to the appeal of investing in QSBS.

The potential for higher after-tax returns on investments is inherently linked to the favorable tax treatment of qualified dividends, which forms an integral part of an effective investment strategy.

What Are The Risks Of QSBS?

Despite its benefits, QSBS also entails certain risks, including limited eligibility criteria and the potential for changes in tax laws that may impact related investments.

One of the primary limitations of QSBS eligibility is the requirement for the issuing company to be a qualified small business, with specific criteria related to its size, structure, and industry. Investors must hold the stock for at least five years to qualify for the tax benefits, which poses a risk in case of early liquidation or market uncertainties.

The eligibility for QSBS treatment may change due to alterations in tax laws, potentially reducing or eliminating the tax advantages associated with qualified small business stock. This susceptibility to regulatory changes emphasizes the need for thorough evaluation and awareness of the risks involved in QSBS investments.

Limited Eligibility

One of the primary risks of QSBS is the limited eligibility for certain shareholders and businesses as defined by IRS regulations, potentially impacting the accessibility of tax breaks and investment opportunities.

This limited eligibility poses challenges for shareholders and businesses seeking to avail of the Qualified Small Business Stock (QSBS) benefits. Such restrictions may lead to missed opportunities for tax advantages and potential growth for businesses, affecting their competitive edge.

It creates hurdles for investors looking to benefit from tax breaks associated with investing in eligible small businesses, thereby influencing their investment decisions and overall portfolio diversification. The implications of limited eligibility for QSBS can significantly alter the dynamics of tax planning, business expansion, and investment strategies.

Potential Changes In Tax Laws

The susceptibility to potential changes in tax laws poses a risk for QSBS, impacting small businesses, capital gains taxation, and federal tax policies governing related exemptions.

Small businesses relying on the Qualified Small Business Stock (QSBS) are particularly vulnerable to the impact of altered tax laws. Any modification in regulations can directly affect the capital gains taxation for shareholders and stakeholders, potentially eroding the incentives and benefits associated with QSBS.

Federal tax policies related to exemptions and favorable treatment for start-up and small businesses might undergo substantial adjustment, leading to significant financial repercussions for these entities. As such, staying informed and proactive in monitoring legislative developments is crucial for businesses utilizing QSBS and investors involved in such ventures.

How To Qualify For QSBS?

Qualifying for QSBS requires adherence to specific guidelines set forth for qualified small businesses, their entity structures, and the considerations related to eligible shareholders and tax incentives.

Qualified small businesses seeking to avail Qualified Small Business Stock (QSBS) designation must pass certain requirements. They need to be C corporations incorporated after August 10, 1993, with total gross assets not exceeding $50 million. Entity structures such as partnerships and S corporations are excluded from QSBS status.

In addition, shareholders must have obtained the stock directly from the business, holding it for at least five years to qualify for the full tax exemption. These regulations aim to stimulate investment in the growth of small businesses by providing tax incentives and fostering economic development.

Choose The Right Business Structure

Selecting the appropriate business structure is crucial for QSBS qualification, with considerations for federal regulations, the exclusion of gains, tax rates, and potential tax savings.

Understanding the impact of federal regulations on business structure is essential for maximizing benefits associated with QSBS. The gain exclusion provision under QSBS allows for significant tax advantages, but the choice of business structure plays a pivotal role in claiming these benefits. Whether it's a C corporation, S corporation, or LLC, each has distinct tax implications affecting potential tax savings. The right structure can lead to substantial tax benefits, making informed decisions imperative for entrepreneurs and business owners.

Meet The Stock Ownership And Holding Period Requirements

Meeting the stock ownership and holding period requirements is essential for QSBS qualification, impacting considerations related to capital gains, shareholder eligibility, the alternative minimum tax (AMT), and potential returns on investments.

For a stock to qualify as QSBS, the ownership and holding period requirements must be met. The shareholder must have acquired the stock directly from the issuing company, and it is essential to hold it for at least five years. This holding period is crucial as it significantly impacts the tax treatment of the capital gains upon the sale of the stock. Meeting these requirements is a determining factor for shareholder eligibility for potential tax incentives.

The consideration of the AMT is also vital, as it affects the potential tax benefits associated with QSBS. Hence, understanding and fulfilling these requirements are imperative for maximizing the potential returns on investments.

Keep Detailed Records And Documentation

Maintaining meticulous records and documentation is vital for QSBS qualification, ensuring compliance with IRS regulations, potential tax savings, and the legal aspects associated with compensation and ownership.

Thorough record-keeping is crucial as it substantiates the eligibility for Qualified Small Business Stock (QSBS) status, enabling entrepreneurs and investors to avail themselves of the substantial tax benefits provided by the IRS. Detailed documentation of stock purchase dates, amounts invested, and holding periods is pivotal for meeting the stringent requirements set forth by the IRS.

Concise and accurate records also play a vital role in substantiating the ownership and compensation structures, safeguarding against any potential legal challenges or disputes.

How To Maximize Your QSBS Benefits?

Maximizing the benefits of QSBS requires strategic considerations related to ownership, compensation structures, partnership dynamics, and the guidance provided by tax advisers to optimize potential returns.

When structuring ownership, it is crucial to consider the shares allocation and voting rights to fully leverage the tax benefits offered by QSBS. Defining compensation arrangements that align with the qualification criteria of QSBS can yield significant advantages, allowing stakeholders to benefit from the potential tax exclusions.

Understanding the interplay of partnership dynamics and decision-making processes is essential for optimizing eligibility and maximizing returns. Consulting with experienced tax advisors is vital to navigate the complexity of QSBS regulations and uncover value-creation opportunities.

Plan Your Exit Strategy

Developing a comprehensive exit strategy is imperative for maximizing QSBS benefits, encompassing considerations related to IRS regulations, tax incentives, college law recommendations, and tax policy implications.

IRS regulations play a pivotal role in structuring an effective exit plan, as compliance is crucial for availing QSBS benefits. Understanding the intricacies of tax incentives is essential to capitalize on the potential advantages while navigating the ever-evolving landscape of college law guidance.

The implications of tax policies underscore the significance of strategic planning to optimize outcomes.

Consult With A Tax Professional

Seeking guidance from experienced tax professionals is essential for navigating the complexities of QSBS, ensuring compliance with legal requirements, and optimizing potential tax savings.

Due to the intricate nature of Qualified Small Business Stock (QSBS), consulting with tax professionals is crucial to fully leverage the associated benefits. These professionals possess the expertise to interpret the complex legal considerations surrounding QSBS, ensuring that all requirements are met to secure the tax savings and protect the company's eligibility.

Tax advisers play a pivotal role in strategizing and implementing the most tax-efficient structures for QSBS, maximizing the potential tax incentives available. Their proficiency in deciphering IRS regulations and tax laws enables businesses to harness the full advantage of QSBS without running afoul of compliance issues.

Consider Holding On To Your QSBS Stock For Longer Periods

Extending the holding period for QSBS stock can yield increased benefits, impacting investment strategies, partnership dynamics, and the potential for enhanced tax incentives and returns.

By prolonging the ownership of Qualiifed Small Business Stock (QSBS), investors can take advantage of the favorable tax treatment offered under Section 1202 of the Internal Revenue Code. This extended holding period can lead to significant tax savings, making it an appealing option for individuals and partnerships.

The long-term approach to holding QSBS stock aligns with strategic investment planning, allowing for potential growth in value and increased returns over time, thus contributing to a more robust and diversified investment portfolio.

FAQ for the Article

Q1: What is Qualified Small Business Stock (QSBS)? A1: QSBS refers to stock in a small business that meets specific IRS criteria. It offers tax benefits to investors in small businesses, including tax exemptions on capital gains if certain conditions are met, like a five-year holding period.

Q2: How does QSBS work? A2: QSBS provides eligible small business shareholders with a tax break, allowing them to exclude part or all capital gains from federal income taxes. This incentive encourages investment in small businesses, especially in high-growth sectors.

Q3: What are the requirements for QSBS? A3: For QSBS eligibility, the business must be a C corporation with gross assets under $50 million. Shareholders must acquire stock after September 27, 2010, and hold it for at least five years. The business should primarily operate in the U.S.

Q4: What are the benefits of QSBS? A4: The main benefit of QSBS is substantial tax exemptions on capital gains, potentially up to $10 million. This allows investors to retain more profits, making small businesses more appealing for investment.

Q5: What are the risks of QSBS? A5: Risks include limited eligibility, as not all small businesses or investors qualify. Also, potential changes in tax laws can impact the benefits of QSBS, making it crucial to stay informed and consult tax professionals.