Revealing The Shark Tank Power Law

by Eric Lam - Published 2/6/2024

by Eric Lam - Published 2/6/2024

In the high-stakes arena of "Shark Tank," where entrepreneurs dream of transforming their startups into titans of industry, an interesting pattern emerges—one that echoes the ruthless laws governing our economic landscape.

In this article, we'll give into a tale of disproportionate success where the victors do not just win; they dominate.

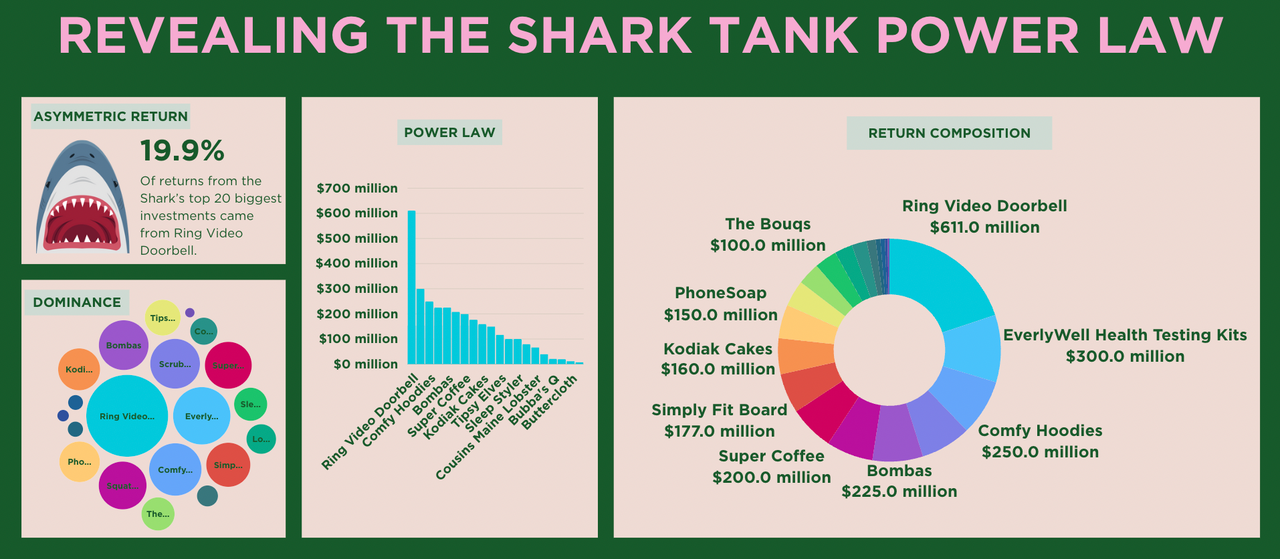

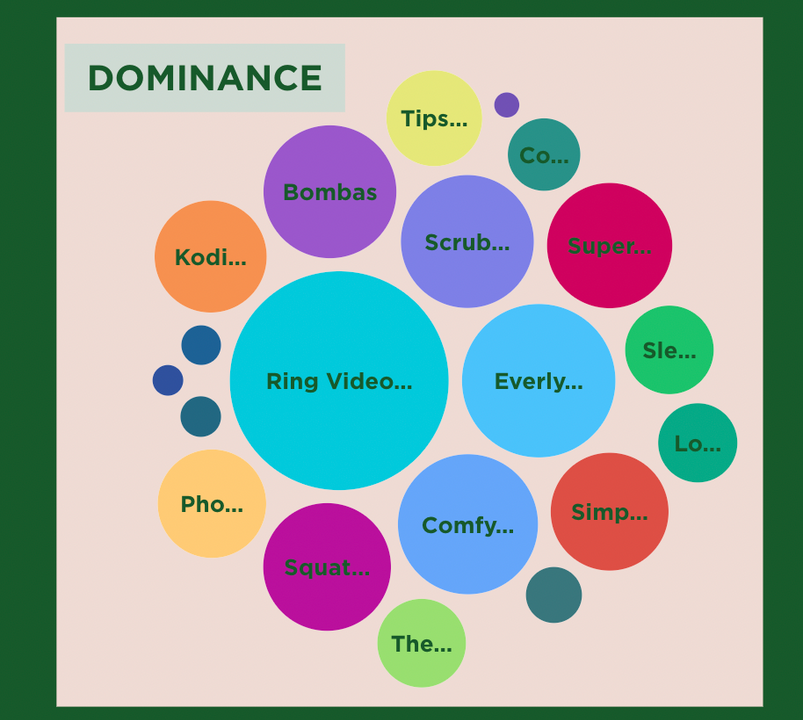

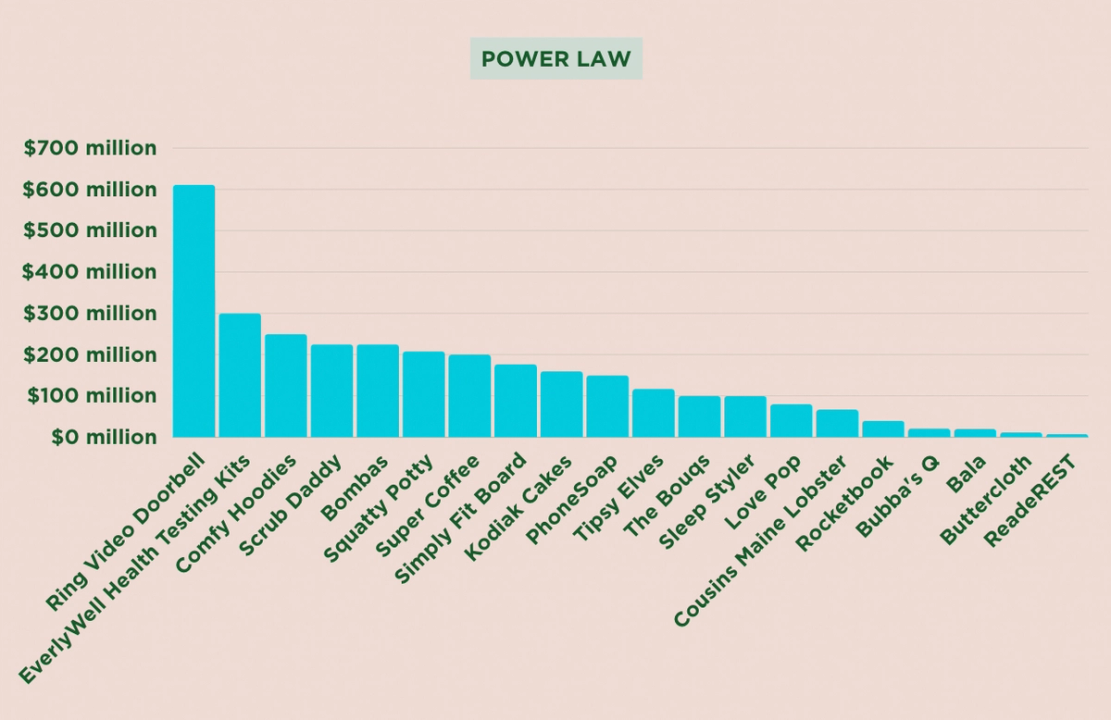

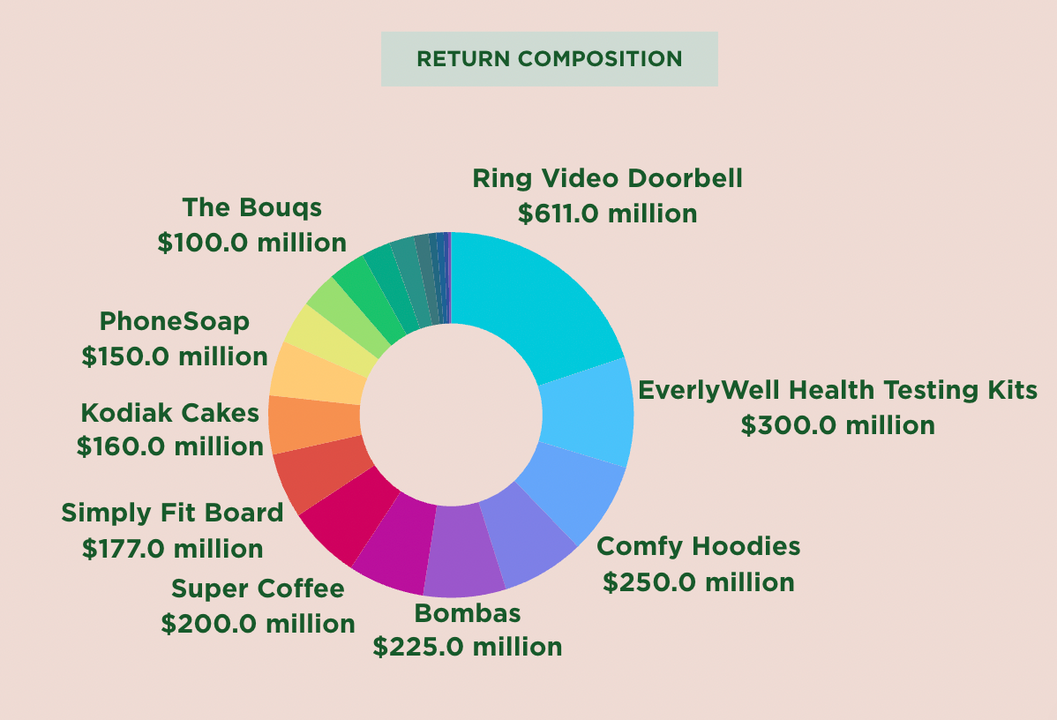

As we dissect the sales figures of the top 20 "Shark Tank" products of 2023, a strikingly uneven distribution is revealed. The gap between the first and second ranks is not a mere step but a giant leap, with the leading product amassing sales that dwarf its closest competitor, and the trend continues down the list. This isn't a story of linear progression; it's a tale of exponential growth and market dominance by a select few.

This intro sets the stage for an in-depth exploration of the vast disparities in success amongst the most lauded "Shark Tank" alumni. Join us as we unravel the layers behind the numbers and the stories of those who rode the wave of the "Shark Tank Power Law" to its crest.

Gathering The Data

In our examination of the most successful "Shark Tank" products, we've adopted a direct and methodical approach. First, we identified reliable sources that track the performance of businesses featured on the show. Specifically, we utilized sales data up to May 2023 from Insider Monkey and The Hustle Story, both of which are respected for their in-depth analysis and comprehensive coverage of "Shark Tank" products.

After gathering the data, our team conducted a thorough analysis to ascertain the total sales figures for each product since their "Shark Tank" debut. To facilitate a clearer understanding of these figures and their significance, we compiled the data into charts. These visual representations are designed to provide insights at a glance, illustrating not only the total sales but also the growth trajectories and market impact of each product.

Top 20 "Shark Tank" products ranked by sales as of 2023:

- Ring Video Doorbell by Bot Home Automation, Inc. - $611 million

- Health Testing Kits by EverlyWell - $300 million

- Hoodies by Comfy - $250 million

- Cleaning Supplies by Scrub Daddy - $225 million

- Socks by Bombas - $225 million

- Squatty Potty by Squatty Potty LLC - $208 million

- Kitu by Super Coffee - $200 million

- Training Board by Simply Fit Board - $177 million

- Pancake Mix by Kodiak Cakes - $160 million

- Smartphone Sanitizer by PhoneSoap - $150 million

- Sweaters by Tipsy Elves - $117 million

- Flowers by The Bouqs - $100 million

- Hair Roller by Sleep Styler - $100 million

- Pop-up Cards by Love Pop - $80 million

- Lobster Rolls by Cousins Maine Lobster - $67 million

- Smart Reusable Notebook by Rocketbook - $40 million

- Ribs by Bubba's Q - $21 million

- Bangles by Bala - $20 million

- Kismet Waves Shirt by Buttercloth - $12 million

- ReadeREST - $8 million

The Power Law

Ring Video Doorbell stands out not just as the #1 investment in terms of sales but also as a prime example of how one massively successful investment can yield returns that are orders of magnitude greater than others. With $611 million in sales, Ring Video Doorbell eclipses the #2 product, EverlyWell Health Testing Kits, by a staggering $311 million. This gap highlights the asymmetrical nature of investment returns where Ring alone accounts for nearly 20% of the total sales of the top 20 products. This asymmetry becomes even more pronounced when considering the combined sales of the products that follow, with none individually coming close to Ring's figures.

This illustrates the quintessential 'home run' investment that can define an entire portfolio.

Early-stage investors often seek out such potential 'unicorns' — companies that can grow rapidly and command significant market share.

The success of Ring suggests the importance of not just the idea or the product, but the scalability and the market's readiness for that product.

Ring capitalized on the increasing concern for home security and the growing adoption of smart home technology, meeting a market demand at an opportune time.

Key Takeaways For Entrepreneurs

- Market Timing: Ring's success underscores the importance of entering the market at the right time with the right product. Aligning a product's launch with emerging consumer trends can be a crucial driver of exponential growth.

- Scalability: The Power Law favors businesses that can scale. Ring's model was highly scalable, allowing for rapid expansion and widespread adoption, which is a trait to look for in potential investments.

- Diversification: For those building an investment portfolio, the Power Law suggests that while most investments will not yield extraordinary returns, a diversified portfolio allows investors to capture the outlier successes.

- Innovation and Adaptability: Ring's continuous innovation and adaptability allowed it to stay ahead of competitors, a trait that is vital for early-stage startups to succeed in the long run.

Conclusion

The asymmetrical success represented by Ring Video Doorbell is a classic embodiment of the Power Law in early-stage investing. It provides a clear example for investors looking for the next big opportunity — it may well be that only a few investments will drive the bulk of returns, underscoring the high-stakes, high-reward nature of investing in startups.

FAQ: Understanding the Shark Tank Power Law

Q1: What is the Shark Tank Power Law? The Shark Tank Power Law refers to the principle that a small number of investments yield the majority of returns. In the context of "Shark Tank" products, it means that a select few ventures have achieved overwhelming success compared to others, dominating the market and sales figures.

Q2: How does Ring Video Doorbell exemplify the Shark Tank Power Law? Ring Video Doorbell exemplifies the Power Law by generating sales that are significantly higher than the other top "Shark Tank" products, accounting for nearly 20% of the total sales of the top 20 featured products. Its success showcases how one standout product can capture a vast share of the market.

Q3: Why is market timing important for entrepreneurs? Market timing is crucial as it can determine the uptake and success of a product. Ring's entry into the market coincided with growing consumer interest in home security and smart technology, driving its sales exponentially. Entrepreneurs need to align product launches with consumer trends and market readiness.

Q4: What does scalability mean for a startup, and why is it important? Scalability refers to a company's ability to grow and manage increased demand without hindering performance or revenue. For startups, scalability is vital as it allows for expansion and adaptation in a growing market, leading to potentially larger returns on investment.

Q5: How should investors approach diversification in light of the Power Law? Investors should build a diversified portfolio to increase the chances of investing in a 'unicorn' that could yield disproportionately high returns. While many investments may not lead to significant outcomes, having a broad investment base increases the likelihood of capturing those few that do, as illustrated by the Power Law.